2024 Schedule C Deductions – There is good news from the IRS this year. The standard deduction that people are allowed to take has gone up. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

2024 Schedule C Deductions

Source : www.wwlp.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.comSchedule C (Form 1040) 2023 Instructions

Source : lili.coWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

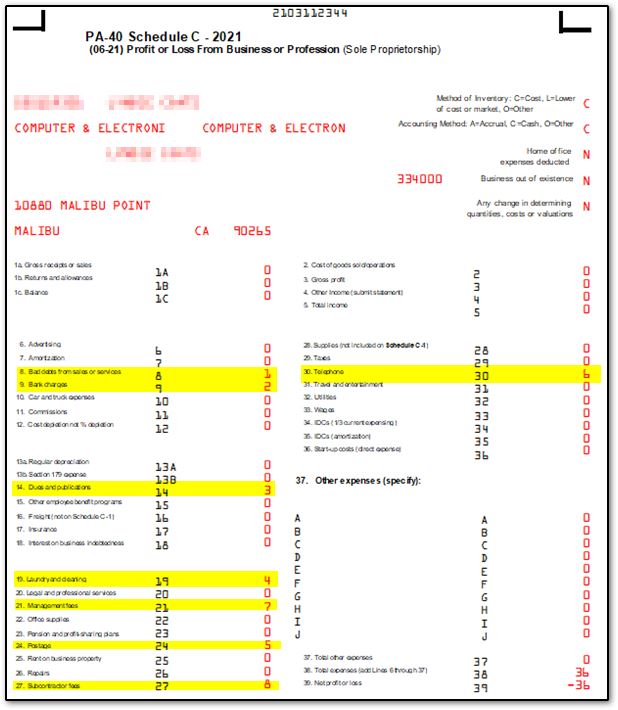

Source : www.nerdwallet.comPA Schedule C Expenses (ScheduleC)

Source : drakesoftware.comSchedule C Expenses Worksheet Fill Online, Printable, Fillable

Source : schedule-c-expenses-worksheet.pdffiller.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgFree Business Expense Tracking Spreadsheet (2024)

Source : www.betterwithbenji.comWhat happened to Schedule C? — Quicken

Source : community.quicken.com2024 Schedule C Deductions Harbor Financial Announces IRS Tax Form 1040 Schedule C : You can deduct expenses of resolving tax issues relating to profit or loss from your business (Schedule C), rentals or royalties (Schedule E), or farm income and expenses (Schedule F) on the . When it comes to receiving your tax refund, timing varies based on several factors. According to the IRS, most refunds are issued within 21 days, but certain situations can cause d .

]]>